How to use the Projection Bands Indicator by Lazy Bear for better performance

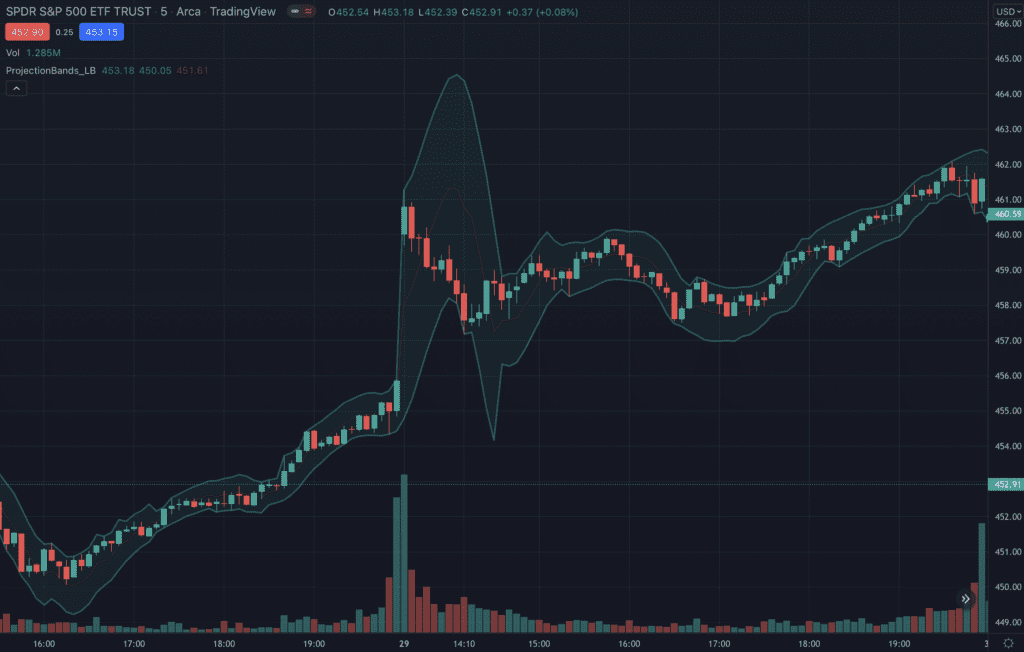

The Projection Bands Indicator is an advanced indicator developed by Lazy Bear. It represents the price movement of a security over a specific time period. The most important part about this indicator is that it brings clarity and transparency to the total price movement of a security over any period of time.

In a nut shell, the Projection Bands Indicator is an indicator that helps you determine the direction of the price movement of a security over a specific time period. It also helps you identify where the price of the security is likely headed. If you trade a lot of options, and you want to know how to use the Projection Bands Indicator then you’ve come to the right place.

In this article, we’ll be discussing everything you need to know about the Projection Bands Indicator including how it works, examples, configuration, trading strategies and more.

What is the Projection Bands Indicator?

The Projection Bands indicator was created by the user LazyBear in order to provide trades with a way to clearly see the price movement of a security over any period of time.

The indicator is composed of two bands that display the price movement of a security over a specific time period. The two bands are separated by a base line.

The indicator is useful for identifying high point of activity, support and resistance levels as well as areas of likely price movement.

How does the Projection Bands Indicator work?

The indicator works by displaying two parallel lines on the chart. The first line is the original price movement of the security and the second line is the expected price movement of the security based on the projection data.

The Projection Bands indicator is a Median-Peak indicator which means that the price of the security is split into two parts. The Median part is the price that occurs 50% of the time and the Peak part is the price that occurs the other 50% of the time.

The Median value is important because it is what the indicator reflects. For example, if the median price of the security is $100 and the indicator reflects a price of $50, then the indicator would say that the security is 50% likely to be $50 and 50% likely to be $100.

Examples of the Projection Bands Indicator

The below chart shows the price movement of Apple from May 19,2017 to May 26,2017. The prediction data for this chart was taken from the 10 day, 20 day and 50 day Moving Average Convergence Curves.

On May 19, the 10 day Moving Average Convergence Curve was at $258 and the 20 day Moving Average Convergence Curve was at $313. So according to the Projection Bands indicator, the price of Apple was at $100 on that day.

The next day, May 20, the 10 day Moving Average Convergence Curve was at $274 and the 20 day Moving Average Convergence Curve was at $315. Overall, the projection data suggested that the price of Apple was likely headed towards $115 by the end of May.

And finally, on May 26, the 10 day Moving Average Convergence Curve was at $300 and the 20 day Moving Average Convergence Curve was at $330. The overall sentiment of the market was that Apple would end the month at $275 or higher. So the projection data was correct in predicting that the price of Apple would end the month at $300 or higher.

Benefits of using the Projection Bands Indicator

The projection bands indicator is an effective way to quickly identify areas of likely price movement and determine the general direction of the price of a security. When used correctly, the projection bands indicator can be a powerful tool for both swing traders and day traders.

The most important part about the projection bands indicator is that it brings clarity and transparency to the total price movement of a security over any period of time. This can help you identify high point of activity, support and resistance levels as well as areas of likely price movement.

Trading strategies using the Projection Bands Indicator

The following are some trading strategies that can be used with the projection bands indicator.

Buy the Dips – The buy the dips trading strategy is based on the assumption that the price of a security will continue to drop. If you were long on Apple on May 19,2017 and the price dropped to $250 by May 26, you could consider buying more Apple shares at $150 since there is a projection that the price may drop even further.

Sell the Squeezes – The sell the squeezes trading strategy is based on the assumption that the price of a security will continue to rise. If you were short on Apple on May 19,2017 and the price rose to $300 by May 26, you could consider selling your shares at $275 since there is a projection that the price may drop even further.

Wait for the Indicator to Hit theirgin – The wait for the indicator to hit the virgin trading strategy is based on the assumption that the price of a security will go against the current trend and return to the median value of the indicator. If you were long on Apple on May 19,2017 but were worried that the price was going to drop even lower, you could simply wait for the Projection Bands indicator to hit the virgin before you sell.

Conclusion

The Projection Bands Indicator is a great way to quickly identify areas of likely price movement and determine the general direction of the price of a security. When used correctly, the projection bands indicator can be a powerful tool for both swing traders and day traders.

The most important part about the projection bands indicator is that it brings clarity and transparency to the total price movement of a security over any period of time. This can help you identify high point of activity, support and resistance levels as well as areas of likely price movement.

If you trade a lot of options, and you want to know how to use the Projection Bands Indicator then you’ve come to the right place.

//

// @author LazyBear

//

// If you use this code in its original/modified form, do drop me a note.

//

study("Projection Bands [LazyBear]", shorttitle="ProjectionBands_LB", overlay=true)

//length=input(14, title="Length")

length=14 // See below why this is a not an input()

sum_c=sum(cum(1),length)

psum_c=pow(sum_c,2)

sump_c=sum(pow(cum(1),2),length)

lsump_c=(length*sump_c)

denom=(lsump_c-psum_c)

rlh=((length*(sum(cum(1)*high,length)))-(sum_c*(sum(high,length))))/denom

rll=((length*(sum(cum(1)*low,length)))-(sum_c*(sum(low,length))))/denom

// Currently there is no way to do a loop. So, "length" is hardcoded to 14.

// Bands

upb=max(high,

max(high[1]+1*rlh,

max(high[2]+2*rlh,

max(high[3]+3*rlh,

max(high[4]+4*rlh,

max(high[5]+5*rlh,

max(high[6]+6*rlh,

max(high[7]+7*rlh,

max(high[8]+8*rlh,

max(high[9]+9*rlh,

max(high[10]+10*rlh,

max(high[11]+11*rlh,

max(high[12]+12*rlh,

high[13]+13*rlh)))))))))))))

//LowerProjectionBand

lpb=min(low,

min(low[1]+1*rll,

min(low[2]+2*rll,

min(low[3]+3*rll,

min(low[4]+4*rll,

min(low[5]+5*rll,

min(low[6]+6*rll,

min(low[7]+7*rll,

min(low[8]+8*rll,

min(low[9]+9*rll,

min(low[10]+10*rll,

min(low[11]+11*rll,

min(low[12]+12*rll,

low[13]+13*rll)))))))))))))

ul=plot(upb, linewidth=2, color=teal)

ll=plot(lpb, linewidth=2, color=teal)

plot(avg(upb,lpb), linewidth=1, color=maroon)

fill(ul,ll,color=teal)